Tax not applied correctly

-

Hi,

Background: I’ve got a website based in Australia where I collect GST for goods sold in Australia. I ship internationally and do not collect tax for products shipped outside of Australia. The price on the product page is input as “tax inclusive”, and I have woocommerce multi-currency enabled (so people see prices in their local currency). This site is live, so when I realised the below problems, I disabled tax and not showing any tax collection to stop incorrect sale prices/tax being calculated and customers asking questions.I originally had an issue with tax being removed from the total price for international customers. Ie. For an item I want to charge $110 for everywhere (and I just absorb the 10% Australian GST Tax):

Australian Customer would see:Total price = Total Price (incl. Tax)

$110 = $110 (incl. $10 GST)International Customers would see (product price discounted the tax amount):

Total price = Total Price minus GST tax

$100 = $110 minus $10 GSTI fixed this original problem through adding in the code snippet found on github, so now all total prices are consistent globally.

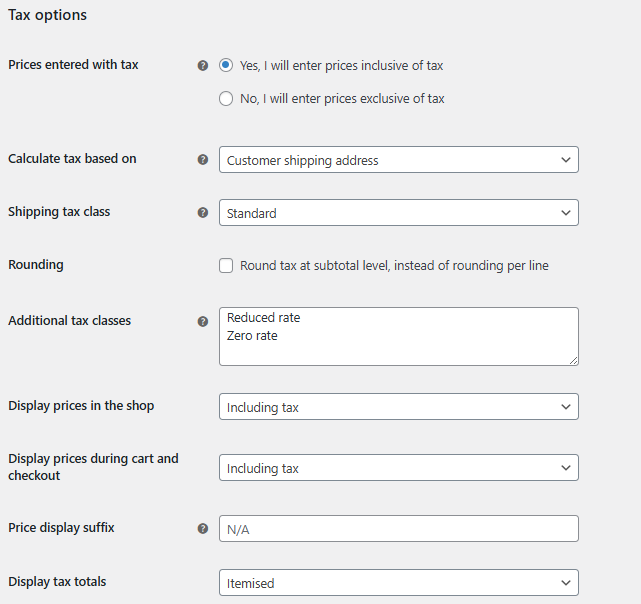

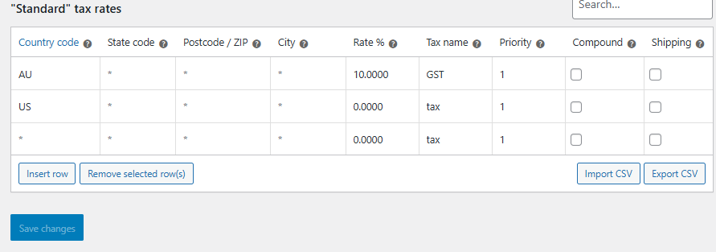

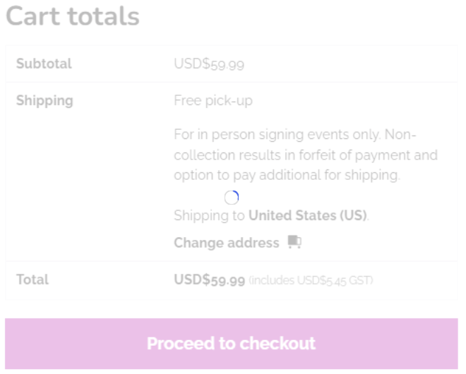

add_filter( 'woocommerce_adjust_non_base_location_prices', '__return_false' )This is when the new problem started to occur. The new problem after fixing the original problem: The user now sees GST being charged everywhere. Below are screenshots from the “tax” tab within Woocommerce and also what people see on the checkout page. As you can see, I’ve marked the priced as entered with tax, calculated tax based on the customers shipping address, and inside the standard rates I’ve set an AU tax rate (of 10%) and “everywhere else” (*) as 0% tax, when that didn’t work, I specifically added in the US as 0% tax, however it still charges GST.

- You must be logged in to reply to this topic.