Incorrect tax being applied on recaulculation

-

Tax is being applied correctly on checkout, but when a recalculation is needed, or when an upsell recalculates an order, the tax table are no longer implemented and customers get charged tax incorrectly! Please see this screen recording:

https://www.loom.com/share/ef6e5c0e3c6f46b7a84aecfb123c814b?sid=1707952d-cf9e-476d-add1-0928b58b56ee

Does anyone know why this is happening?

-

Hello reubenlara

Thank you for contacting us.

I understand you are facing a problem on your site where incorrect is applied whenever a recalculation is needed.

Could you share a screenshot of your tax settings?

I want to review how it is set up.To help you further, I’d like to review your site’s System Status Report.

You can find it via WooCommerce > Status.

Select Get system report and then Copy for support.Once you’ve done that, you can paste the text in https://paste.mozilla.org/

After that, you can paste the generated link here in your reply.Looking forward to your response. ??

Best regards.

Hello! thanks for the help.

Here’s the tax settings: https://www.dropbox.com/scl/fi/q4tfr5i272maixqor606z/BDTC-tax-settings.png?rlkey=hsfqp0tb4tgitcly7crpud0ni&dl=0

Here’s the system report: https://paste.mozilla.org/OSa1h3sz

Thanks!

Hi @reubenlara,

The SSR link has expired, could you share it again, please? However, basing on your screenshot you’re using our WooCommerce Tax extension, correct?

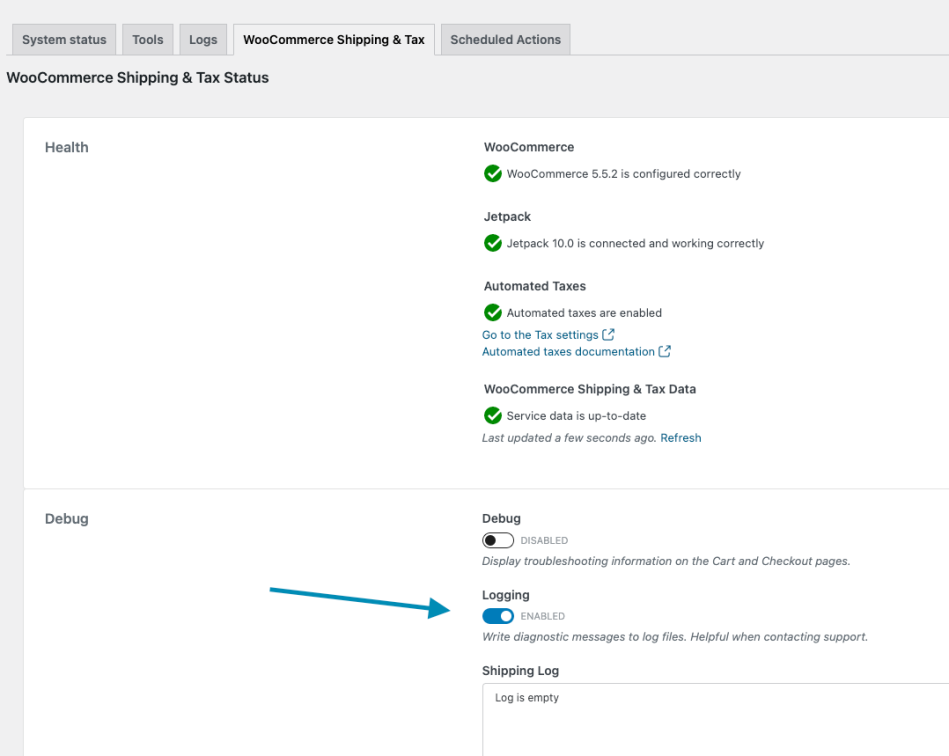

If so, please go to?WooCommerce > Status > WooCommerce Shipping & Tax and?enable debug and/or logging.

The system status page displays issues that could cause WooCommerce Shipping & Tax to stop functioning and contains helpful debug information, plus links to get further assistance.

The most recent tax requests can be seen on the?WooCommerce > Status > WooCommerce Shipping & Tax?under the?Taxes Log?section. Older requests can be viewed by going to?WooCommerce > Status > Logs.

Thanks!

-OPSorry, here is the SSR: https://paste.mozilla.org/YPyS3bxC

“Tax log”: https://paste.mozilla.org/YbsPc7kJ

“Other log”: https://paste.mozilla.org/darG2jEW

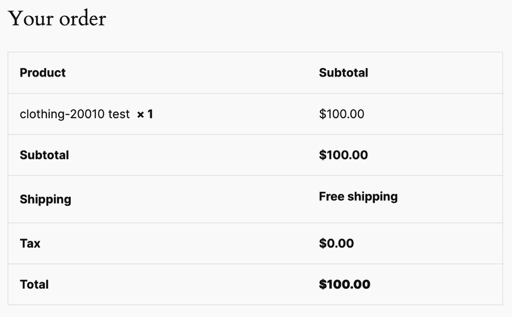

What you see reflected in this last log is the same problem. T-shirt checks out with no tax (this is correct in MA, USA), but then on “recalculate” it adds the standard 6.25% tax on the apparel item, even though the apparel item has the tax class of “clothing-20010”.

Here’s a screenshot of the test order from this log: https://www.dropbox.com/scl/fi/okpd9d5t9mmz83vnkawd4/test-order.png?rlkey=t65zx7yd40iofsitkrdqvljqn&dl=0

Hey, @reubenlara!

Thanks for the information.

Can you please share screenshots of what you see under Standard rates and clothing-20010 rates?

Looking forward to your reply.

Have a wonderful day!

Please watch this brief screen recording to see what is happening with the tax tables: https://www.loom.com/share/44cdfaa9294b4cf8a0214540d838cf30?sid=656dc3c0-0ec7-44da-82b2-35894cbe29b7

Thanks!

Hello reubenlara

Thank you for making a video.

It is very helpful.The “clothing-20010” tax is the Massachusetts clothing sales tax.

Which is added by the WooCommerce Shipping & Tax plugin.As you have shown in the video, the tax is indeed not working correctly.

In Massachusetts, all clothing and footwear items at $175 or less are exempt from sales tax.

Further details can be found in this post:

https://www.taxjar.com/blog/retail/handle-massachusetts-clothing-sales-tax-online-storeNow find out what is causing this to malfunction, could you let me know if you have any custom code added to your site? I noticed that you have two plugins installed:

1- Snippet Shortcodes

2- Code SnippetsIf you have any custom codes in these two plugins, share screenshots of those with me.

I will review it and move toward fixing this issue.Looking forward to your response. ??

Best regards.

Here are all of our Snippets. Thanks!

Hello reubenlara

Thank you for your reply and sharing a video.

I tried to recreate this problem on my test site.

My test site has the same address store as yours and the WooCommerce Shipping and Tax plugin is active. Automated taxes are also enabled.However, I could not recreate the problem on my end.

The additional tax class “clothing-20010” is not auto-created on my site.

To confirm, could you delete the “clothing-20010” from the Additional tax class box?

Does it come back again?Looking forward to your response. ??

Best regards.

The “clothing-20010” never automatically appeared. I had to add it manually (as per WooCommerce Shipping & Tax instructions). The automated tax code recognizes the international standard code as apparel (and correctly does not tax those products for Massachusetts when they are assigned as “clothing-20010”) . Deleting “clothing-20010” does not make it automatically appear again. The only thing that gets automatically created are the tax tables, and only after this (or any) “Additional tax class” is specified. Even when I delete rows, the tables automatically populate. To note again, though: the plugin is correctly identifying the tax class on first order, but not on order recalculation. I need the recalculation to identify and apply the same tax class category whenever any function (such as post-purchase upsells) triggers WooCommerce order recalculation.

hello @doublezed2 , any updates to this fix? Thanks!

Hey @reubenlara ??

Thanks for your patience while we checked this. I believe that what you’re observing is somewhat expected. WooCommerce Shipping & Tax works at the cart/checkout pages level, by automatically fetching the correct tax rate, but the Recalculate button is a WooCommerce core feature. This means that what happens there is outside the scope of WooCommerce Shipping & Tax.

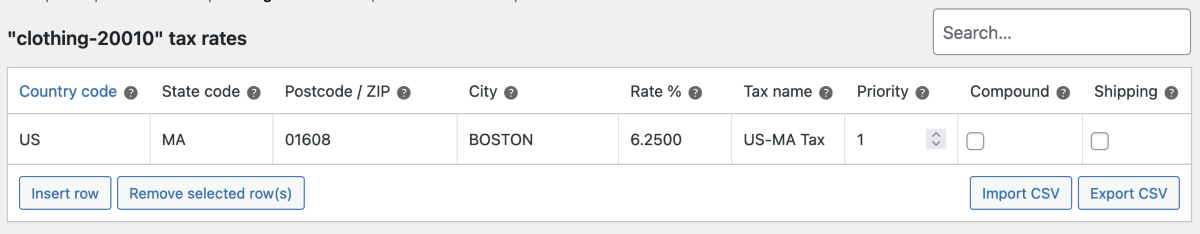

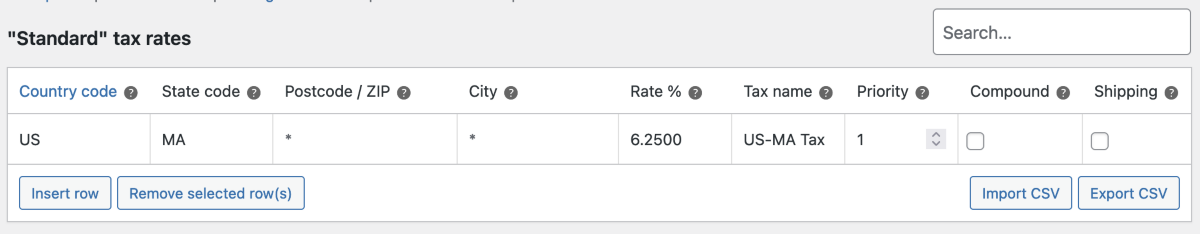

To clarify: when a customer adds an address to the checkout page, the WooCommerce Shipping & Tax plugin will make a request to the TaxJar API and then save the tax rate that applies to that post code for future use. That is where the tax rates in WooCommerce > Settings > Tax > Standard / clothing-20010 are coming from. With each new post code on the checkout page, a new tax rate is added to the respective tax table — the order doesn’t even need to be placed, just adding the address to the checkout is enough.

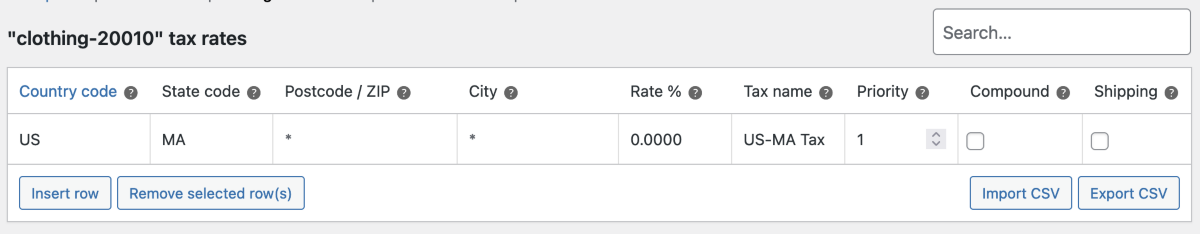

The standard tax rate will always be the one that gets saved. In this case, we’re using an additional tax class (

clothing-20010) that the TaxJar API recognizes as “clothing products”. As the destination address is in MA, and sales tax does not apply to clothing in MA, then the standard tax rate will not be applied.Here’s the tax rate that is saved:

And here’s what the checkout is showing at the same time:

However, if later you go to recalculate that order for some reason, the TaxJar API is no longer part of the equation. This means that WooCommerce will be relying solely on the tax rate that is configured, which will be the standard one that was fetched previously.

So, to sum it up, for your use case, WooCommerce Shipping & Tax might not be the best solution. You can look into disabling automated taxes and manually configuring the tax rates like this to solve the recalculation issue:

Or, you could look into a more featureful alternative like Avalara AvaTax. For any questions about AvaTax, please contact Avalara directly.

Please let us know if we can be of any further assistance.

-

This reply was modified 6 months, 1 week ago by

Paulo P - a11n. Reason: Images

Hi there ?? ,

We haven’t heard from you in a while, so I’m going to mark this as resolved. Feel free to start a new thread if you have any more questions.

All the best,

Omar -

This reply was modified 6 months, 1 week ago by

- The topic ‘Incorrect tax being applied on recaulculation’ is closed to new replies.