I am experiencing an issue with my WooCommerce store where the product prices are changing based on the customer’s shipping location, despite having configured my settings to include VAT in the displayed prices. I have set the option to “Yes, I will enter prices inclusive of tax,” and I have verified that all products are assigned the correct tax class with appropriate rates for each location.

However, when I change the shipping address during checkout, the product price fluctuates instead of remaining constant.

My goal is for the product price to remain fixed while displaying the applicable VAT amount based on the specific location.

Could you please assist me in resolving this issue?

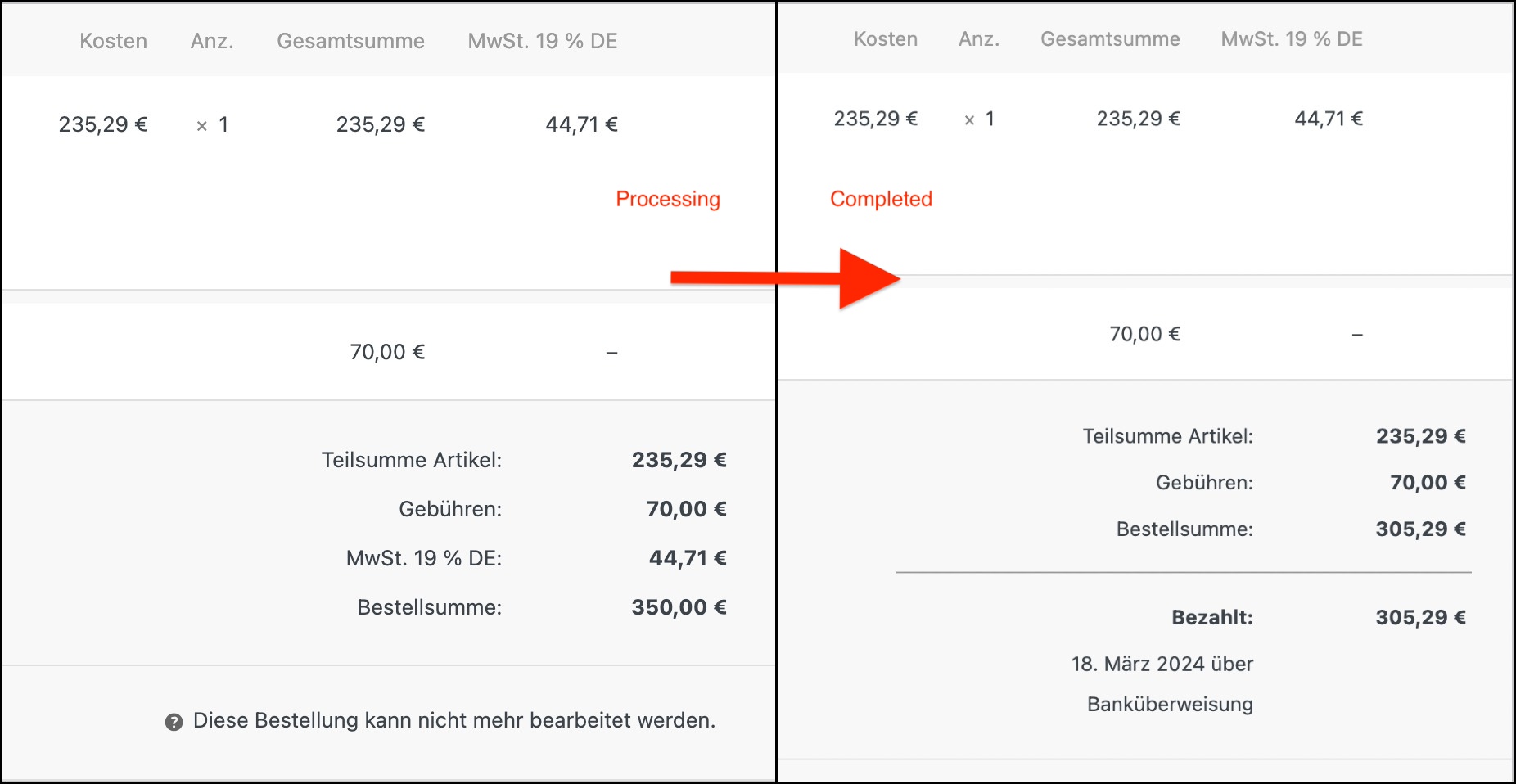

I am encountering an issue with the total amount calculation when updating the order status from “Processing” to “Completed”. I have noticed that the tax amount is not being correctly accounted for in the total amount displayed.

Here is the scenario:

During the “Processing” stage:

Subtotal of Items: €235.29

Fees: €70.00

Tax (19% DE): €44.71

Order Total: €350.00

After changing the status to “Completed”:

Subtotal of Items: €235.29

Fees: €70.00

Order Total: €305.29

Paid: €305.29

As you can see, the tax amount of €44.71 is not being included in the order total after changing the status to “Completed”, resulting in an incorrect total amount of €305.29 instead of the expected €350.00.

I have ensured that all plugins and WooCommerce itself are up to date, and the tax settings are correctly configured. Despite this, the issue persists.

Could you please assist me in resolving this issue? Any insights or guidance would be greatly appreciated.

Thank you in advance for your help.

Best regards,

Erik Küchle

I need a solution where the taxes are based on the product location.

We use the RnB plugin to create a website where you can book a house or apartment. The client we are developing this site for is from Canada. In Canada you pay the tax not where the customer is from or where the store address is but where the house or apartment you want to book is located.

And this is currently giving me a lot of trouble because I can’t solve this.

I hope there is someone here who knows about this problem.

I When I began using woo-commerce I set my tax settings for my prices to be entered including tax. I now need to change it to exclusive of tax but for the existing prices to remain the same.

All future prices will be exclusive of tax.

Can anyone please advise on how I can make this change or the steps I need to follow.

Many thanks

]]>The products (along with prices) has been imported from a Prestashop install into woocommerce. At the time of the import the “I want to enter prices incl. tax” was set to “No”. Now i would like to change the setting to “Yes” – making it possible to enter the full price of a product including tax. The tooltip for the setting claims that changing this setting will not effect existing products, however when I change the setting all prices on existing products are reduced.

I assume that this is not expected behavior, however I lack ideas on how to solve this issue.

Suggestions for a solution are much appreciated.

]]>and i use round prices e.g. 12,50 22,50 25,00 30,00

but my site keeps showing exclusive tax prices like 24,79 20,66

i changed the settings a few times but notting changes

also all settings where inclusive when products where added

and at this point i have no clue on how to solve this and my site goes live in a few days :-/

]]>I’m hoping someone can help me.

I’ve gone through the threads and posts on here and tried the suggested solutions to no avail.

Whenever I set-up the tax to be inclusive of product price, “Yes, I will enter prices inclusive of tax”, the setting reverts back to exclusive of tax, ” No, I will enter prices exclusive of tax”.

https://prnt.sc/WZgjisZgAWUF

I’ve been wracking my brains, disabled plugins, cleared cache (tried incognito), then realised I needed to update Woo (thinking that would solve the problem), but it didn’t.

So far nothing’s worked.

Am I missing something? Are there any suggestions anyone can offer?

Thanks

]]>This shop is based in the UK and sells all over Europe (and worldwide). I have this set up with the following tax settings so that we can have the UK charged 20% VAT and everywhere else at 0% VAT (ie not being applied at checkout).

– Prices are entered inclusive of tax

– Prices displayed in shop including tax with display suffix (ex. VAT {price_excluding_tax})

– All country codes and tax entered for 0% VAT in standard rates with priority of 1

– Recently had to change ‘calculate tax based on…’ option to select ‘shop base address’ as we randomly had the shop prices showing the same for main price and suffix price with or without VAT. However, when testing this doesn’t seem to make a difference.

For example, we had one order yesterday from Guernsey (set up for 0% VAT) which was still charged 20% VAT at checkout, and another from Poland (set up for 0% VAT) which was also charged 20% VAT at checkout.

I feel I’ve missed something simple but cannot seem to resolve this, any help at all from you guys would be so appreciated.

Thanks so much in advance!

]]>