Standard vs. additional tax classes

-

From time to time, my client lets me know that tax have not been collected on their orders. It’s usually due to Jetpack no longer being connected. I have no idea why it randomly disconnects, but is there anything that can be done to avoid that or notify me when it is disconnected?

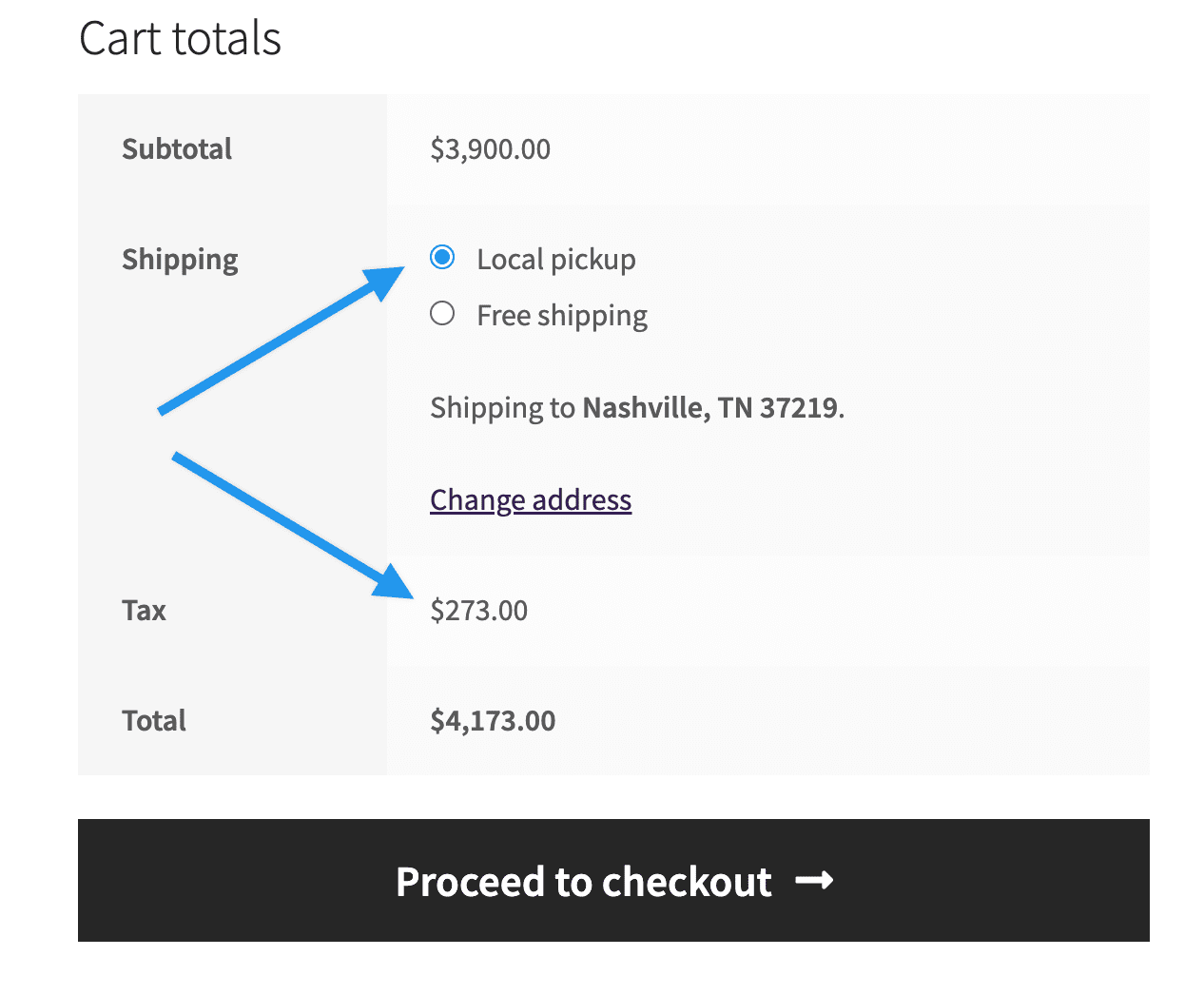

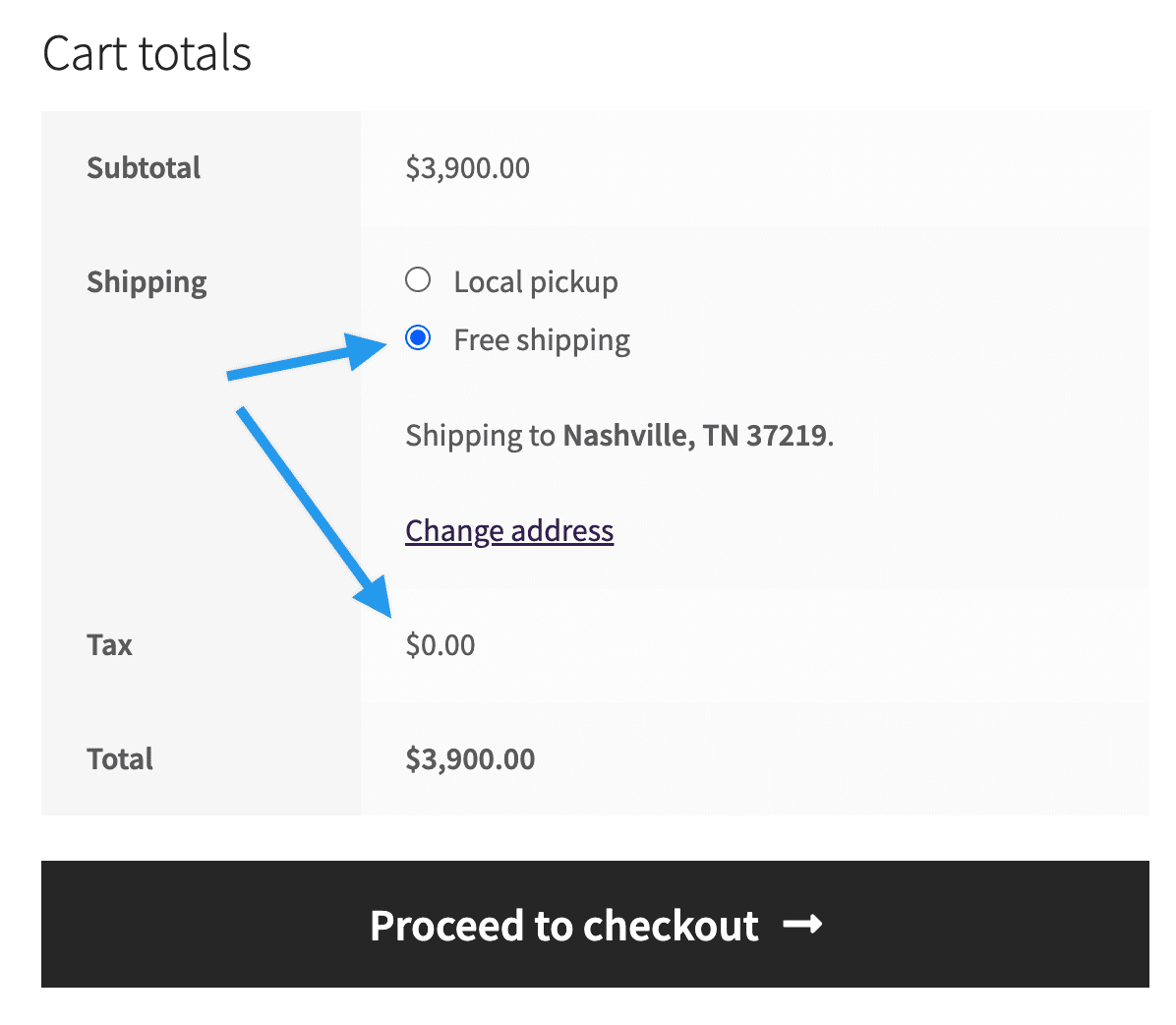

I noticed that a couple of orders did have tax collected. They both were using the standard rate (using automated calculation based on ZIP code of shipping address), but all of the others were using additional tax classes I have set up (events that will take place at one of 3 store locations).

Why would it be able to grab the tax rate for the orders using the standard rate, but not the additional tax classes? I would think it would be the opposite because those are a set rate, not based on the customer’s ZIP code, so they don’t need the automation to happen.

- The topic ‘Standard vs. additional tax classes’ is closed to new replies.